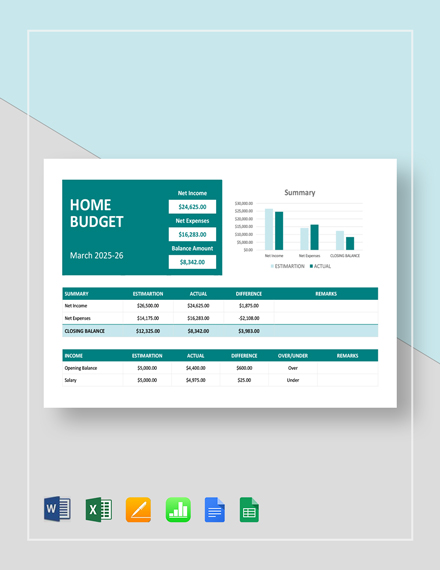

It’s hard to know if you’re making progress without this kind of information. Reports can help you compare spending from month to month and across categories. Charts/reports: Most budgeting apps give you some kind of overview of your income and expenses, letting you visualize the big picture.Budget alerts: It’s nice to get a notice before you go over budget for the month.Can the app tell the difference automatically? If not, can you categorize transactions yourself? This is one of the most useful aspects of budgeting apps. Automatic transaction categorizing: “Groceries” are purchases from the grocery store “Dining out” are purchases at restaurants.

Simple home budget software update#

Simple home budget software free#

Manage spending and plan for monthly billsĮvery budgeting app aims to help you track spending and save money, but they come with a variety of features.You might need a budgeting app to help you: All that would be difficult or impossible to replicate on your own, but budgeting apps make it easy. Many apps generate reports to show how your finances change over time.

They can automatically sync up with all of your bank accounts and payment cards, categorize your transactions, and give you a bird’s-eye view of what you buy and how much you spend each month. But even wealthy people could spend and save more wisely with the help of a budget.īudgeting apps take a lot of the work out of making and maintaining a budget. If you’re living paycheck to paycheck or struggling with debt, your need for more control over your finances might be all too clear. A budget can give you a clear picture of how much money you have coming in and going out. If you make and spend money, it’s likely that you could benefit from a budget of some kind. Guide to Choosing the Best Budgeting App Determine Your Need for a Budgeting App Free basic version PocketGuard Pro: $7.99 per monthīudgeting tool is free 0.89% for investment accounts under $1,000,000

0 kommentar(er)

0 kommentar(er)